People, product & process

Hi, I'm Felice D'Addario, streamlining creativity within organizations across B2B & B2C for strategic impact and scale.

With more than 20 years of design industry experience. I specialize in UX with a diverse background spanning agency and in-house roles across sectors like B2C, B2B, enterprise solutions, e-commerce SaaS products, and complex internal platforms. Renowned for transforming product development, I excel in simplifying challenges, fostering collaboration, and guiding teams to deliver exceptional user experiences.

My commitment to the end-user experience involves scrutinizing E2E journeys, aligning user needs, securing stakeholder buy-in, and crafting cohesive user journeys while scaling teams and optimizing processes.

It's all about results

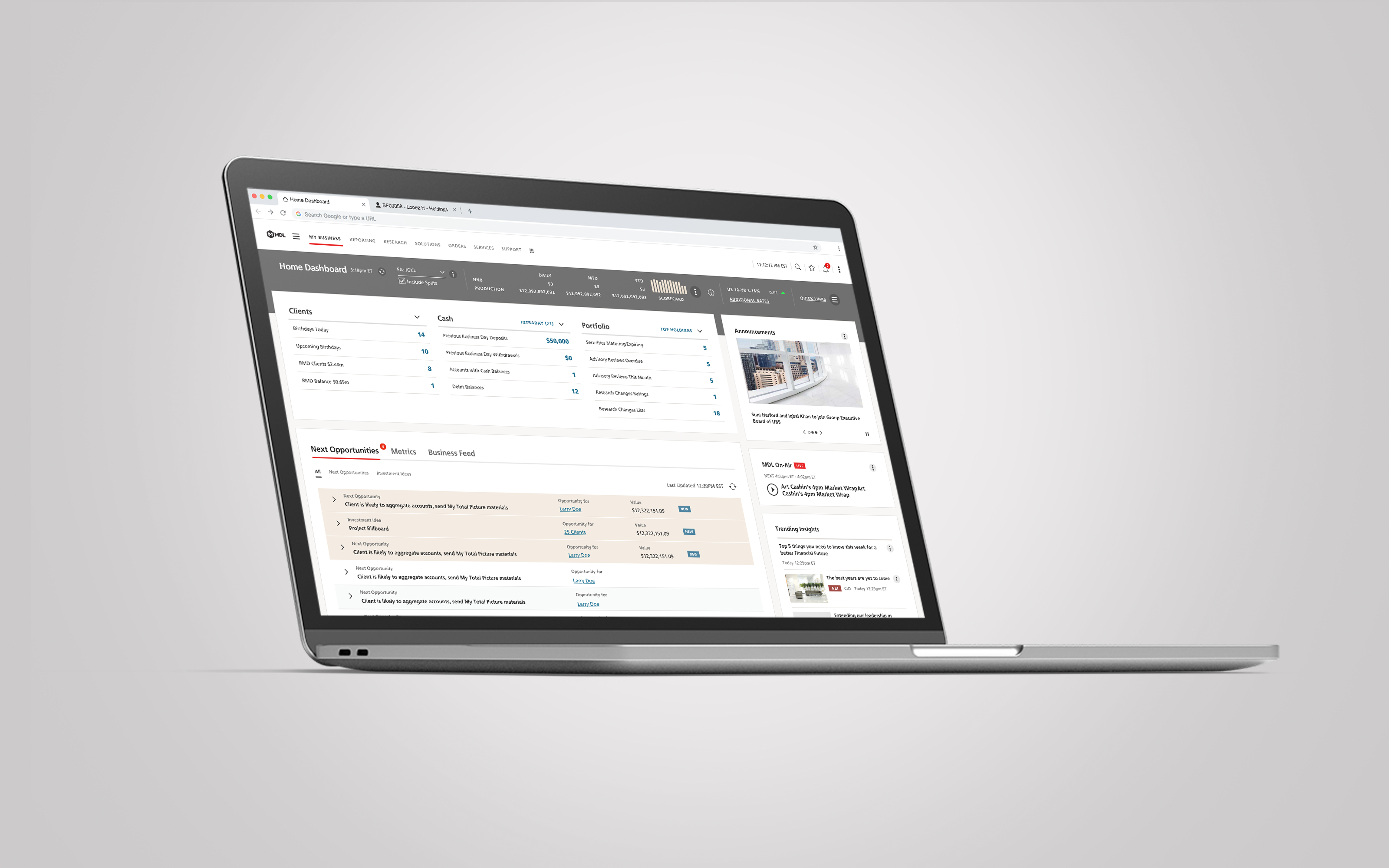

UBS Financial Services

- Achieved 23-36% daily productivity surge for 7,250 financial advisors, CSA's, and field users, translating to annual business savings between $3 to $5 million

- Saved business $10-15M in professional fees, over the course of 5 years through in-house scaling

- Internal user satisfaction surged from an average of 64% to 88%

- ADA integration significantly mitigated the risk of potential lawsuits, thereby safeguarding against potential legal expenses

- Spearheaded the creation and evolution of an entire design Center of Excellence from its inception, driving its development and growth from the ground up

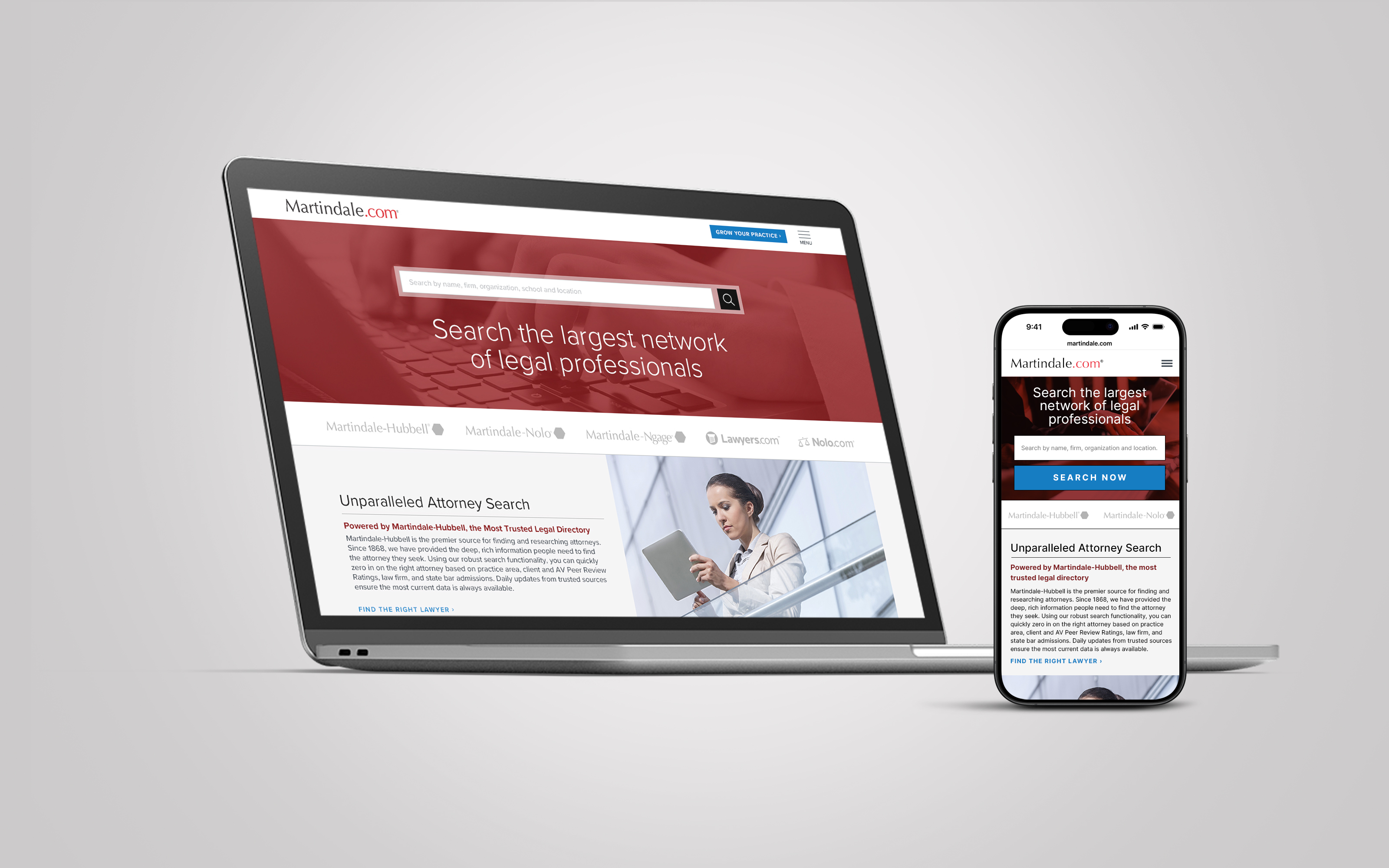

Internet Brands | Martindale-Hubbell

- Member of an elite team instrumental in driving the revenue of our website template product line to nearly double its previous figures

- Maintained $4M in annual revenue by securing new business and resolving troubled accounts

- Exceeded conversion KPIs, achieving 10% to 22% growth for flagship B2B and B2C websites

- B2B client retention improved from 70% to 88% within first year

- Increased customer satisfaction from 65% to 90%

LexisNexis | Martindale-Hubbell

- Raised first-time design approvals from 25% to 78% without changing the creative team

- Improved email metrics: Open Rate from 16.78% to 28.47% and Click Rate from 1.35% to 3.66%

- Doubled team efficiencies in throughput while boosting team morale and enhancing overall product quality

- Enhanced client retention rate from 38% to 90% for new template line and 68% to 92% on custom product line

Design Philosophies

Building a House in Digital Design:

Just like constructing a house, digital design requires understanding user needs, meticulous planning, and a strong foundation to combine functionality with visual aesthetics.

Storytelling in Design:

Designers are storytellers, crafting engaging narratives that guide users through their journey, emphasizing content hierarchy for a meaningful experience.

Consistency in Design:

Consistency across content, branding, and interfaces is key to exceptional design, ensuring a seamless and reliable user experience.

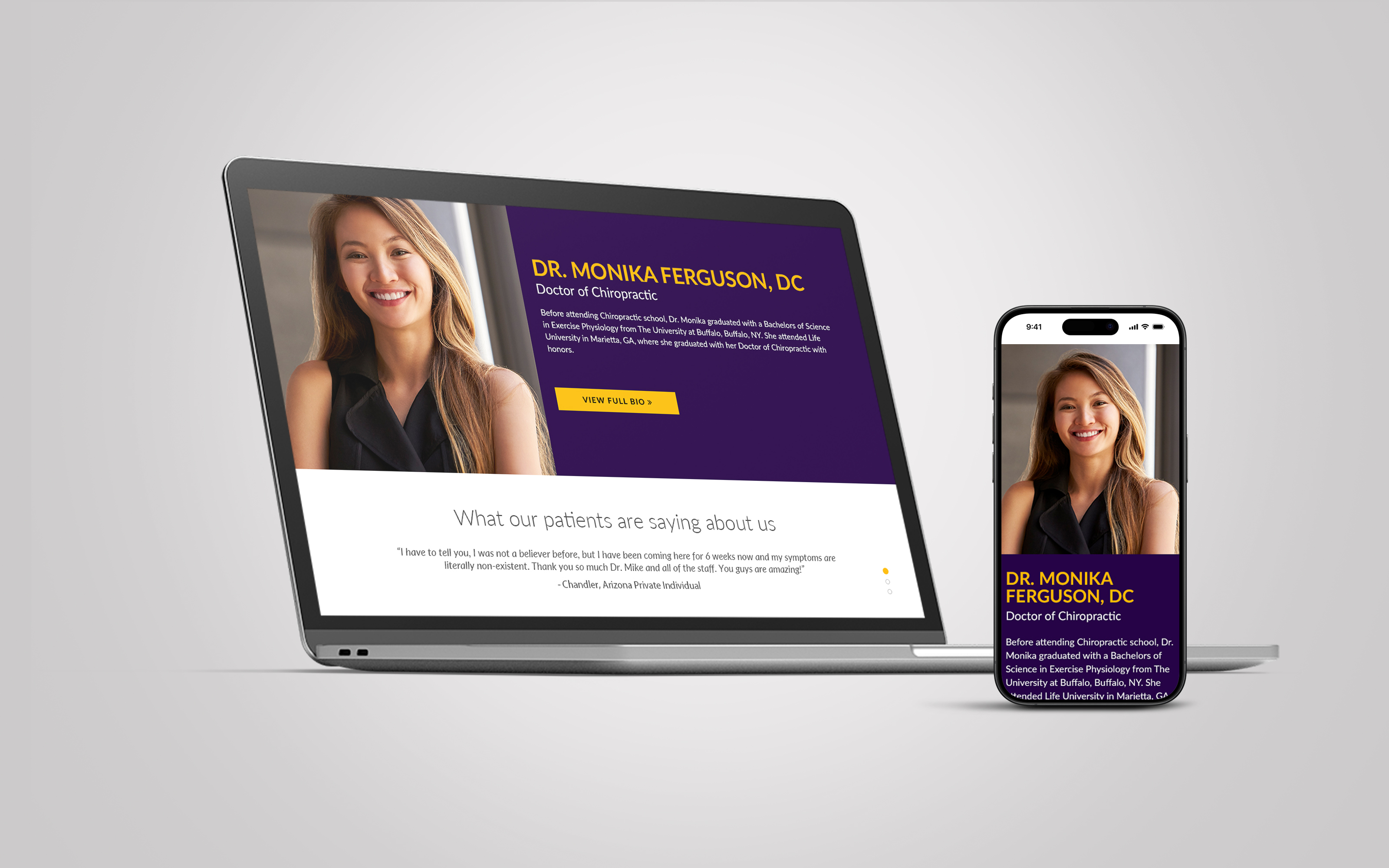

My Work

- All

- UX Case Study

- Branding

- Personal

My expertise extends to scaling, whether it involves building teams from the ground up or optimizing existing teams for enhanced efficiency and performance. My focus on People, Process, and Products allows me to excel in mentoring and challenging team members, streamlining and refining processes, and revitalizing products to bring order to organizational chaos.

20

+

Years of experience

05

Average tenure

13

Years as a Creative Leader

350

+

Hilarious dad jokes

Clients

01